Crowdfunding 103 - Regulation D

Welcome back folks!

Like Reg A, Reg D has two categories, or “flavors”, that we’ll discuss in detail below.

Either way, for the most part, Reg D offerings are restricted to “accredited” investors.

So before you bother digging in to what those deals are all about, you probably need to figure out whether you’re an accredited investor yourself, or not.

Here’s how.

What is an Accredited Investor?

One of the most important distinctions for Reg D offerings is that, except where noted below, the only people allowed to participate in these deals are a special class of people called “accredited investors”.

So what are those?

When it comes to individuals, most of the time the question of whether or not you’re accredited comes down to money.

If you earned at least $200,000/year for the past two years (or a combined $300,000/year with your spouse), and reasonably expect to maintain that level, you’re accredited.

The second wealth test to be considered accredited (and you only need to pass one, not both) is if you have a net worth of at least $1 million, excluding the value of your primary residence. And yes, again, you can combine net worth with your spouse.

Outside of that, there’s a knowledge/skills-based path: If you hold the Series 7 (General Securities Representative), Series 65 (Investment Advisor Rep) or Series 82 (Private Securities Offering Rep) securities licenses through FINRA, you too are considered an accredited investor.

There are a number of pathways for legal entities (including businesses, funds and trusts) to being considered accredited, as well, but the dollar amounts connected with those tests are even higher than those stated above for individuals, and that info is probably a little outside the scope for most of you.

Now that we’ve got THAT out of the way, much like Reg A, there are technically two “flavors” of Reg D. We’ll address them in reverse order, because most people are more likely to run into the second one than the first.

Regulation D (Rule 506(c))

Who Can Invest: Nice and easy. This one is for accredited investors only, no exceptions.

Investment Limits: Accredited investors can invest as much as they please in a Reg D 506(c) securities offering.

Investment Process: There are two key things to keep in mind about 506(c) offerings.

First, the issuer and their bankers are allowed to advertise these deals and make the market aware of them, much like Reg CF and Reg A issuers can. It’s called “general solicitation.” This is the main reason that we expect you’ll be more likely to become aware of a 506(c) deal as opposed to 506(b) offerings.

Second, issuers are not allowed to take an investor’s word that they are accredited. They have to take reasonable steps to verify the potential investor’s status. There are all kinds of ways they can do that, including getting copies of a person’s tax returns or bank statements; asking for a verification letter from the person’s accountant, lawyer or money manager; and looking up a person’s securities licenses on the FINRA website.

All of this might be handled through special online tech, as Reg As and CFs are, or it may be a more old-fashioned process using Docusign, or even scans or faxes of necessary paperwork. Ultimately it’s up to the issuer. But use of investment tech is becoming more and more commonplace in Reg Ds because of the rise of crowdfunding.

Risks and Returns: Just like Reg CF and Reg A securities offerings, Reg D offerings are very often early stage and higher risk than investing through the stock market. Do not think that—just because Reg D is largely reserved for the wealthy—it is necessarily a safer investment than an equivalent deal under A or CF.

If you know that large institutions are also investing in the deal, that may mean that the issuer has more options if things get tricky in the future, but plenty of VC-backed companies go belly-up as well, and we are starting to see more Reg CF offerings co-backed with institutional money. So there’s no explicit clear-cut edge for Reg D on the risk front.

Very similarly to Reg CF, but NOT similar to Reg A, Reg D securities are restricted. If it’s a publicly traded company running the Reg D offering, you can’t resell the securities for six months. If it’s a private company, the holding period is one year. Even after those deadlines run, other restrictions—such as divestiture limits or management approval for the sale—may still apply.

Ultimately, investors in Reg D are looking for the same thing crowd investors are: company growth followed by a public listing, sale, or future “priced round” with the opportunity for investors to sell.

Issuer Characteristics: Reg D offerings are a lot more free-form and loosely regulated than Reg A or Reg CF. There’s no maximum size for a Reg D offering—they’re theoretically unlimited in scale. And all kinds of structures are permitted, including the Special Purpose Vehicles or SPVs we discussed back in the Reg CF piece.

Issuers do still need to file some paperwork with the SEC for a Reg D offering, in the form of what is called a Form D. But the Form D is super-streamlined relative to Forms C and 1-A. It is mostly fill-in-the-blank driven. Issuers don’t even need to file one until they’ve already started selling the securities. They have up to 15 days from the first sale under the Reg D offering to file a Form D.

Also, like Reg A, issuers are not required to use a broker-dealer, and again the funding portals that run Reg CF deals are not permitted to manage Reg Ds.

Regulation D (Rule 506(b))

Who Can Invest: Ok so this one is slightly funky. Issuers can bring in as many accredited investors as they want, like 506(c). But also, up to 35 “sophisticated” nonaccredited investors are allowed to invest in these deals.

This is likely meant to help accommodate all kinds of friends and family of the company’s founders, not just the rich ones. Moreover, since you’re not advertising these deals (see below), there’s a better chance that everybody being brought into them will have had meaningful conversations about these investments with the founders or their representatives.

Investment Limits: Like 506(c) Reg D offerings, 506(b) deal investors have no maximum investment amount.

Investment Process: Here’s where 506(b)’s uniqueness comes into play in force. Reg D 506(b) private placements are a little more “private” than their (c) counterparts, in that they can’t use “general solicitation or advertising” to create awareness.[1]. So no ads. As a result, 506(b) is very much a “who you know” exercise. Existing personal or business networks are fair game, and that includes the connections of any broker or intermediary the issuer might hire to help. Again, this was why we said you might have encountered fewer deals of this type—unless you’re already pretty plugged in to private investing or capital markets.

We also mentioned that the nonaccredited investors in these deals need to be sophisticated. Essentially SEC wants these investors to have enough finance and business expertise to be able to evaluate the pros and cons of these investments.

Interestingly, there’s no set rule for what determines whether a prospective investor is sophisticated enough to participate in these deals.[2]. The issuer can look at the person’s investment experience, profession, education, any advisors they may have, and perceived understanding of risks, among other factors. Because this is a bit of a gray area, it’s probably a good idea for issuers to document what they did to make the assessment. But that’s on them, not you.

SEC also requires that issuers give extra information to these nonaccredited investors, essentially at the same level as what issuers are required to provide under a Reg A offering (which, while not quite at the level of a publicly traded company, is pretty darned close). The issuer also has to make itself available to answer questions from nonaccredited prospects.

Meanwhile, for accredited investors under a 506(b) offering, things also get easier. Unlike a 506(c) deal, accredited investors under a (b) are not required to provide any verification information about their accredited status. They can “self-certify” (which by the way, they can also do under Reg CF and Reg A). In other words, the issuer just gets to take their word for it.

Risks and Returns: Risks and return profiles for Reg D 506(b) deals are essentially the same as their 506(c) counterparts, including the limitations on resale.

Issuer Characteristics: The rules here are the same for Reg D 506(c)s, with the exception that, if you’re including any nonaccredited investors, you need to meet those Reg A-like disclosure standards.

But because the Form D you’re required to file as the issuer is so streamlined, 506(b) issuers will often produce the additional required information through a separate document, called a Private Placement Memorandum (or PPM for short). They could also technically make the document a slide deck—although it would probably be a pretty long one—so long as it includes all of the necessary information.

Risk disclosures are one item that the SEC is big on. If there’s no PPM, a smart issuer will often put those right into the investment contract (or “subscription agreement”).

So, there you go!

Now you’re a crowd investing whiz!

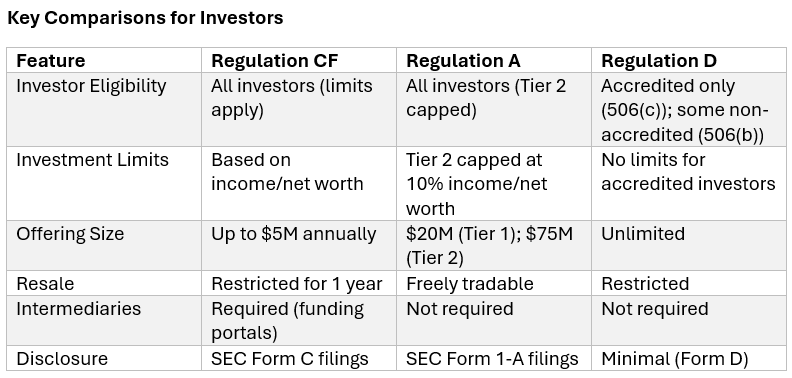

But that was a lot of information. So here’s a handy chart to summarize:

Conclusion

Thanks for joining us on this overview of the investment crowdfunding space. There are always new wrinkles popping up in this fast-changing industry, but hopefully we’ve helped demystify it for you a bit, at least enough to think about dipping a toe into the water when you find the right deal.

But the jargon is just the tip of the iceberg. There’s a whole skill set to evaluating these companies.

Additionally, some of them are just a better fit to succeed through these channels than others.

And new crowd issuers come to market every single month. And none of them are in your Schwab account.

How could anybody hope to stay on top of all of this?

Don’t sweat it.

You’re part of Disruptor Nation now.

Just stick with me, and we’ll navigate these waters together.

Stay tuned for regular updates in your inbox about how I evaluate these deals, all of the latest developments, new crowd issuers, and other trends.

Til next time!

Sean Levine

Managing Editor

Disruptor Nation

[1] https://www.sec.gov/resources-small-businesses/exempt-offerings/private-placements-rule-506b

[2] https://www.linkedin.com/pulse/deep-dive-regulation-d-part-4-rule-506b-blake-e-robbins-mryhc/